What Does Pvm Accounting Do?

What Does Pvm Accounting Do?

Blog Article

The Of Pvm Accounting

Table of ContentsThe Buzz on Pvm Accounting8 Easy Facts About Pvm Accounting ExplainedUnknown Facts About Pvm AccountingGetting My Pvm Accounting To WorkHow Pvm Accounting can Save You Time, Stress, and Money.Not known Incorrect Statements About Pvm Accounting The Definitive Guide for Pvm AccountingNot known Details About Pvm Accounting

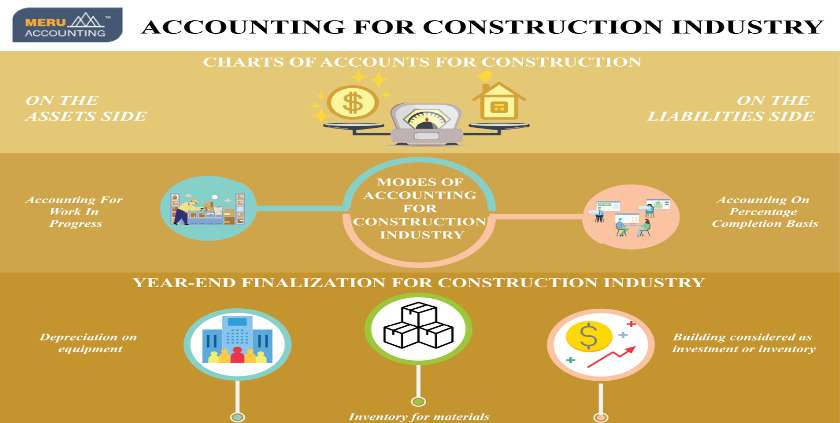

One of the primary reasons for applying bookkeeping in construction projects is the requirement for monetary control and management. Accountancy systems offer real-time understandings into job costs, earnings, and productivity, enabling task managers to without delay identify potential issues and take corrective actions.

Accounting systems allow firms to keep track of capital in real-time, guaranteeing adequate funds are available to cover expenditures and satisfy economic obligations. Reliable cash flow management assists protect against liquidity dilemmas and maintains the project on course. https://pubhtml5.com/homepage/ijerc/. Building and construction jobs undergo numerous economic mandates and reporting requirements. Appropriate audit guarantees that all monetary deals are videotaped accurately which the task follows audit requirements and legal agreements.

Little Known Facts About Pvm Accounting.

This reduces waste and enhances job effectiveness. To better understand the relevance of audit in building and construction, it's additionally necessary to identify in between construction management accounting and task administration bookkeeping. mostly concentrates on the monetary elements of the building company in its entirety. It handles overall economic control, budgeting, money flow monitoring, and monetary reporting for the entire organization.

It focuses on the monetary aspects of private building jobs, such as price estimation, price control, budgeting, and cash circulation monitoring for a particular job. Both kinds of accountancy are crucial, and they complement each various other. Building and construction management accountancy makes sure the business's financial health and wellness, while task management accounting makes certain the financial success of individual projects.

All About Pvm Accounting

A crucial thinker is called for, who will collaborate with others to choose within their areas of duty and to surpass the locations' work procedures. The placement will certainly engage with state, college controller staff, campus department team, and scholastic scientists. This individual is anticipated to be self-directed once the preliminary understanding curve is overcome.

The smart Trick of Pvm Accounting That Nobody is Talking About

A Building Accounting professional is accountable for managing the financial aspects of construction tasks, including budgeting, price tracking, economic reporting, and compliance with regulative needs. They work very closely with task supervisors, specialists, and stakeholders to guarantee exact monetary documents, expense controls, and timely payments. Their knowledge in construction accounting principles, job setting you back, and economic analysis is vital for effective monetary management within the building sector.

The Greatest Guide To Pvm Accounting

As you have actually probably found out by currently, taxes are an inescapable component of doing business in the United States. While most emphasis typically exists on federal and state revenue tax obligations, there's likewise a 3rd aspectpayroll tax obligations. Pay-roll tax obligations are taxes on a staff member's gross wage. The incomes from payroll taxes are utilized to money public programs; Click This Link because of this, the funds accumulated go directly to those programs rather than the Internal Income Solution (IRS).

Note that there is an extra 0.9% tax obligation for high-income earnersmarried taxpayers who make over $250,000 or solitary taxpayers making over $200,000. Earnings from this tax go towards government and state unemployment funds to aid employees that have actually shed their jobs.

Getting My Pvm Accounting To Work

Your deposits need to be made either on a month-to-month or semi-weekly schedulean political election you make prior to each calendar year. Regular monthly repayments. A month-to-month repayment must be made by the 15th of the following month. Semi-weekly repayments. Every various other week deposit dates depend upon your pay timetable. If your cash advance falls on a Wednesday, Thursday or Friday, your deposit is due Wednesday of the following week.

So look after your obligationsand your employeesby making complete pay-roll tax payments in a timely manner. Collection and repayment aren't your only tax obligation obligations. You'll likewise have to report these amounts (and various other info) consistently to the internal revenue service. For FICA tax (as well as federal income tax), you should complete and submit Form 941, Company's Quarterly Federal Tax Return.

10 Simple Techniques For Pvm Accounting

States have their very own payroll taxes. Every state has its very own unemployment tax (called SUTA or UI). This tax price can vary not only by state but within each state too. This is since your company's sector, years in service and joblessness history can all identify the percentage made use of to calculate the quantity due.

Things about Pvm Accounting

The collection, compensation and coverage of state and local-level tax obligations depend on the federal governments that levy the taxes. Plainly, the subject of payroll taxes includes lots of relocating components and covers a vast array of accounting knowledge.

This web site makes use of cookies to enhance your experience while you browse via the web site. Out of these cookies, the cookies that are classified as needed are saved on your web browser as they are crucial for the working of fundamental capabilities of the web site. We likewise utilize third-party cookies that aid us assess and comprehend exactly how you use this website.

Report this page